- its three to four times less expensive to acquire expansion revenue from existing customers than it is to earn revenues from new logo customers?

- the likelihood of selling to an existing customer is 60-70%, while the probability of selling to a new prospect is only 5-20%? (MarketingMetrics)

- if you increase customer retention by 5%, you can increase profits from 25-95%? (Bain)

Is it any wonder that 63% of sales leaders said that their top priority is now “Driving growth through existing customers” (Forrester). Additionally, with more revenue and business models built on subscription services, companies are making more significant investments in customer success and other post-sale teams to assure renewals and help drive expansions.

Help post-sale teams drive account retention & expansion

So how do you ensure post-sale teams (e.g. customer success and account management) achieve better retention and expansion in existing accounts, so important to today’s business priorities and achieving growth goals?

You must make a decided change in quarterly business reviews and engagements to achieve success.

First, your customers have gotten more frugal. Renewals or expansions now receive additional scrutiny and constraints. First, your customers have gotten more frugal. Renewals or expansions now receive additional scrutiny and constraints. According to LinkedIn, 51% of sellers report their buyers have experienced budget cuts. Even more, Gartner shows 26% of organizations have implemented zero-based budgeting due to the pandemic, meaning that every renewal, expansion, and purchase decision has to be financially justified.

According to Forrester, 75% of purchase decisions now have Executives as decision-makers (versus 58% previously). And 51% have Finance as decision-makers (versus 35%). The new breed of decision-makers cares less about adoption and usage than operational stakeholders. They instead want to understand how the investments in solutions have yielded tangible business results.

Because of this, post-sale teams must need to shift from tactical reporting to communicating business outcomes. It all comes down to Realized ROI.

Use Value Enablement to Grow Existing Accounts

Our advice, implement Value Enablement to enable your post-sale teams to have quarterly executive business reviews that evolve from discussions about operational objectives and metrics like adoption and usage to outcomes, business value, and ROI.

Six Steps to Value Enablement for Customer Success

Here are six steps post-sale teams can leverage to better engage customers, communicate and quantify Realized ROI, and grow existing accounts:

1. Align with critical customer business objectives – Any improvements achieved with your solution only become significant to the executives and finance team if they contribute to key business objectives. First and foremost, the post-sale team should understand from the customer how successful solution delivery should impact key business objectives.

Typical business objectives that you can align solution delivery to include:

- Accelerate digital transformation

- Improve customer experience (Cx)

- Grow the business

- Reduce costs and improve margins

- Open new markets

- Shift the business model

- Improve agility and flexibility

- Reduce supply chain risks

- Improve regulatory and compliance

- Accelerate and ease M&Aval

2. Identify the right metrics to track in order to illuminate outcomes – Equipped with these key business objectives, the post-sale team should document the key performance indicators (KPIs) that the solution can positively impact. These key performance indicators can be divided across the following Value Map categories:

- Cost – spending on legacy systems, maintenance contracts, business service fees, and expenses

- Productivity and processes – time spent on work and tasks that can be automated, reduced, or eliminated; process steps and errors that can be streamlined or avoided

- Business risks – current security, availability, disaster compliance, and regulatory risks.

- Business growth – revenue growth, expansion, and customer experience opportunities

It is important to have a catalog of KPIs aligned to business objectives, in order to guide post-sale teams and your customers, as many customers will not know what KPIs to leverage.

It is also important to focus on a select group of KPIs to start with – the ones aligned to the business objectives, most easily measured and tangible, and relevant to the stakeholders involved. Ensure there are a few “elevated” metrics, above the tactical/operational impacts, to consider. These will help your post-sale team better engage and communicate value in a way that finance and executives will care about to grow existing accounts.

3. Tally historical benchmarks – Once the right metrics are identified, record the starting value, where the KPIs sat prior to the solution implementation and improvement. This may be difficult if your customer does not remember the starting value. To help:

- Created a pre-sales business case that documents the starting value and the predicted improvements

- Use post-sale kickoffs to document starting values of the KPIs

- Leverage surveys to get input from several stakeholders to ensure a more complete understanding of the KPIs across the business areas to be improved

- Leverage real customer KPI benchmarks to document what other customers have as their starting value

- Leverage the solution itself to measure and report on actual key metric values where and when available

4. Quantify improvements – In each business review and at least once a year, for each KPI identified, improvements need to be measured and communicated to the customer. Collaborate with the customer to estimate the impact the solution has had on each metric. The tally of quantified improvements can be done:

- via surveys of key stakeholders or discovery questions to determine the specific savings or business value improvement to document

- via reports or an API with the solution application, leverage metrics collected to directly determine improvements

Over time, the improvements can be tallied and recorded to show improvements in the indicators.

If a pre-sales business case was developed, the target impacts can be compared to the current progress to determine how well, or how short the progress is compared to expected outcomes. This is important for triage, perhaps focusing on adoption, usage, change management or process improvements to drive to the expected outcomes.

5. Convert KPI impacts into quantified business value – For each metric improvement, it is valuable for the post-sale team to move beyond just a list of KPI impacts, also converting the improvements into financial business benefits. Each KPI can be converted into a savings or growth financial impact. For example:

- If the solution helped to accelerate time to market for new product launches by 2 months, use an average value per product per month to quantify the incremental revenue, and a margin to determine the margin contribution.

- If the solution helped to reduce the time spent on tactical operational tasks each week by 8 hours, tally the financial value using average fully burdened salary rates.

In order to tally the financial impacts, you will need additional information (e.g., about average salaries or product value per month). This information should be provided by the customer. You can also leverage customer benchmarks from prior analyses, industry research from sources like Payscale, or research firms like Gartner or Forrester as a guide.

For each quarterly, semi-annual, or annual value review, it is important to tally and record each improvement to show the progression of savings and growth provided and understand how well the solution is in delivering anticipated outcomes.

6. Compare to investments and tally ROI/key net financial impacts – Once the value is documented, it is important to compare the savings and gains the customer has achieved versus the investment made. For the investment, it is key to collect not just the licensing and infrastructure cost for the solution or service but also the expenses for services, customization, deployment, project and change management, training, and learning spent from the initial kickoff to date.

The comparison of the investments versus the benefits is best summarized over time to show the financial summary values the financial and executive stakeholders find most important, including:

- Net Benefits – a tally of the total benefits achieved minus the total investment

- Return on investment (ROI) – a ratio of the net benefits/total investment

- Payback period – a determination of how many months it has taken for the project to pay for itself, meaning for the cumulative benefits to overtake the cumulative investment (if that line has indeed been crossed with realized value).

Prove realized ROI to grow existing accounts

For post-sale teams to effectively quantify and communicate Realized ROI to help retain and grow existing accounts, deploy several key capability/maturity improvements across five areas, and continue to evolve them as you develop, deliver and scale your program. Those areas include:

1. People – In order to engage your customers on realized value, a shift and elevation in skills within the post-sale team may be needed. This means empowering and coaching team members to transition discussions from the current implementation, project management, triage, and adoption/usage talk track to discussing business objectives, KPIs and business value. The team also needs to be enabled to use analysis and value assessment tools put in place to scale your Realized ROI success. Training and certification, role plays, continuous learning, and active coaching are all important to ensure your post-sale team is capable of evolving to a business value approach.

2. Process – The post-sale process is often driven by Quarterly Business Reviews (QBRs) and managed by customer success platforms such as Gainsight. Many organizations that have implemented a Realized ROI/value-centric approach to post-sale engagement have elevated one or more of their QBRs with customers to Executive Business Reviews (EBRs), evolving from operational reporting to outcomes management. One or all of the reviews conducted throughout the year will be reshaped to drive discussions about business objective alignment, KPI improvements, business value achieved, and ROI realized.

3. Tools – An interactive Value Enablement platform, and in particular a Realized ROI business value component/tool is essential. This application can serve as the heart of the Realized ROI program (and more, supporting all value engagements and value enablement throughout the customer lifecycle – from initial touch, through pre-sale, into post sale and expansion). The interactive Realized ROI application will help automate some key functions for the post-sale team, including:

- Documentation of key business objectives and challenges being addressed with the solution

- Discovery of key performance indicators including historical metrics and achieved improvements

- Quantification of the savings and business value from the KPI improvements

- Summary of the key financial impacts including ROI, payback and net benefits

- Comparison to proposed targets from the pre-sale financial justification/ROI business case

- Tally and visualization of the improvements and value over time

- Provide great visuals to make the tool easy for customer success to use in collaborative meetings with key customer stakeholders

- Automatically create customer-ready assessment reports and presentations for use in QBRs/EBRs

4. Integration – Any commercial applications and tools need to be integrated into the platform where sales and post-sale reps live and breath every day. Integration into Gainsight is key for any Realized ROI application, where the interactive Value Enablement tools can leverage security/access control, run from the Gainsight environment, pull key customer licensing, usage, profile, and insights information from Gainsight, and share key discovery and Realized ROI data back into Gainsight.

More advanced, your solution may be able to collect key metrics to help inform the KPI with actual data, versus discovery and surveys. Integration of the Value Assessment tools with your solution as well as other third party systems could provide a running tally of actual data to inform the Realized ROI assessment.

5. Intelligence – The Value Assessment tool should be leveraged to inform the customer success data set with business objective, challenge, historical, and value achievement information. This data can be centralized in Gainsight for action and reporting or leverage a third-party data and analytics solution.

With the data in place, you can leverage Machine Learning (ML) and Artificial Intelligence (AI) to identify where processes are being followed (or not), determine which customers are most likely to attrite, especially to guide precious customer success engagement focus and triage. There isn’t a post-sale group I have talked to that isn’t struggling with hiring enough good reps to ensure coverage on key accounts. AI/ML-enabled technology can really help to prioritize resources and time where they are needed most.

Realized ROI in action

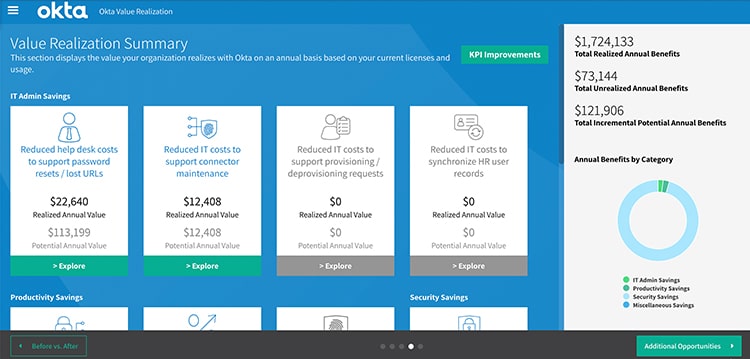

Okta value engineering and customer success have leveraged Mediafly for the past three years to evolve their customer engagements from discussing deployments, adoption and usage, to discussing value realization.

The Okta team uses a customized Realized ROI tool to assess the value achieved by each customer in leveraging Okta solutions, helping the customer success rep discover historical and actual KPIs, and tally financial impact and Realized ROI. Significant improvements in elevated engagements and retention have resulted from the Realized ROI assessment tool, and a time-consuming and difficult process for the customer success team has been automated and scaled to cover most key accounts.

Importantly the Realized ROI tool also helps the Okta team to quantify the value “left on the table” by not having complete adoption and not having complete coverage. This has been invaluable to their efforts to grow existing accounts.

The Bottom-Line

Post-sale teams that adopt a value-centric approach experience significant benefits including improved retention and the ability to accelerate growth in existing accounts.

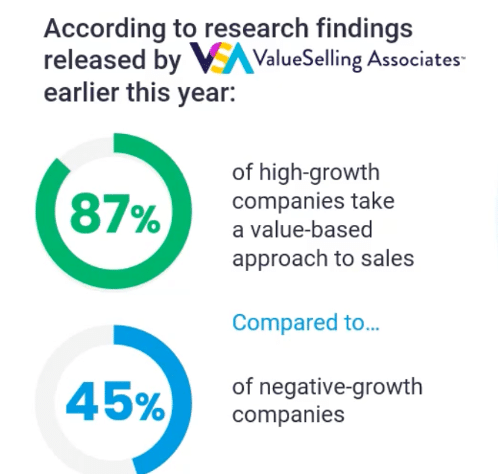

According to our partner Value Selling Associates, 87% of high growth companies take a value-based approach with their customers compared to 45% of negative-growth companies.

Want to learn more about value selling? Download the Sales Leader’s Guide to Value Selling in 2022.

Comments are closed.