As the sales enablement space becomes more competitive, acquisitions and consolidations will become more pertinent in the industry. Given Seismic’s recent acquisition of SAVO, Mediafly CEO, Carson Conant, provided insight into what this means for the marketplace and explained why focusing on opportunities for differentiation, growth and customer success is crucial.

#1 – Sales enablement consolidation validates industry growth and work

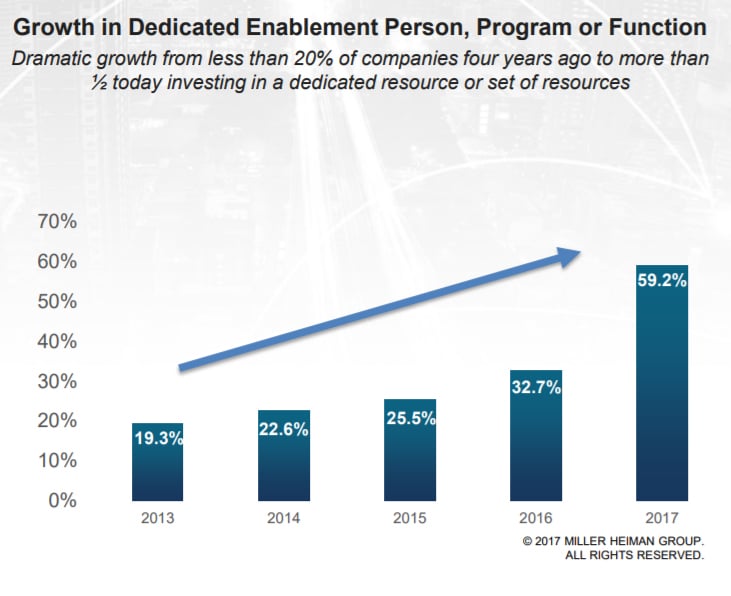

The sales enablement industry has been on the rise for many years, and not only for our immediate environment. The landscape of sales enablement can be broadened to include tools such as interactive sales calculators, sales apps, email automation, data enrichment and analytics, as well as CRM, so it’s no wonder consolidation is happening. Sales enablement consolidation validates the need for companies to align sales and marketing in order to engage buyers in a more effective way.

#2 – Sales enablement consolidation forces differentiation among competitors

With fewer players in the field, it becomes easier for buyers to see a difference between the products and services sales enablement companies offer. This creates a great opportunity for sales enablement companies to carve out their own space in the eyes of their prospects.

To differentiate themselves, companies must put a strong emphasis on innovation.

Those who focus their efforts on delivering the most impactful solutions will rise to the top. But innovation goes beyond the product. The brand, the company culture, the customer management, all become opportunities for doing things better and for differentiation. Companies that find themselves bogged down by system integrations, entangled operational processes and out-of-date technology will quickly fall behind in all these areas.

More than ever, companies need to focus on the needs of buyers. Customer success teams will become an important factor as transitions occur. Customer success teams can make or break an acquisition. Yet when consolidation combines 500 customers under one roof, it’s bound to be difficult to keep up with their unique needs.

In most mergers and acquisitions, sales, marketing, and customer care efforts stall, as management becomes busy formulating the consolidation rationale for their internal and external audiences. According to TechCXO, “many companies put off this crucial sales organization integration decision until days or week after the closing, creating disruptive sales force confusion which can lead to sales “stars” exiting on both sides.”2 It’s nearly impossible not to let things fall through the crack when transitioning to different systems, introducing new team leaders and getting up to speed on customer history and requirements.

To learn more about Mediafly’s Sales Enablement Solution, contact us here.

About Mediafly

Mediafly is a mobile sales enablement solution that enhances how brands engage prospective buyers. By using Mediafly’s platform, marketing and sales teams at companies including PepsiCo, GE Healthcare, MillerCoors and Charles Schwab, are able to deliver custom, dynamic sales presentations quickly and efficiently, engaging customers with insights that are relevant to them. Mediafly’s Evolved Selling™ solution enables sellers to be more flexible and interactive in their sales interactions, resulting in increased sales and stronger customer relationships.

Evolved Selling™ takes sales enablement to the next level by incorporating methodologies and technology that enhances engagement with prospective buyers. Read more about our approach to Evolved Selling™.

Sources:

1) 2017 CSO Insights Sales Enablement Optimization Study. pp. 1–42, 2017.

2) Oess, Matt. (18 May 2017). Acquisition Integration Part 2 – Sales and Marketing [TechCXO]. https://www.techcxo.com/acquisition-integration-part-2-sales-marketing/.

Comments are closed.