It should come as no surprise with the current economic conditions and uncertainty, that finance leaders are looking for ways to reduce costs, consolidate vendors and do more with less.

-

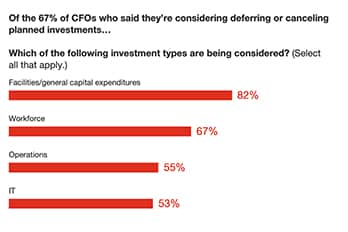

According to a CFO Pulse survey from PwC:

- 67% of surveyed executives indicate that they are deferring or canceling planned investments,

- Discretionary spending is under scrutiny as a means to further reduce costs

- Processes are being put in place to tighten approvals for new spending — even among businesses that are well-capitalized – and to prioritize what programs to cut and which ones to protect.

As a solution provider, you need to be aware that almost all areas of your customer’s business are under scrutiny by executive leadership and CFOs. In particular, capital expenditures, spending on facilities, workforce, operations and IT are under extreme pressure. There are a couple of bright spots, in digital transformation, customer experience and cyber/privacy are less at risk for cutbacks.

-

Frugal Existing Customers

- Understands exactly how your solution aligns to address key business objectives post-crisis

- Can clearly communicate the value and return on investment realized from your solution (Realized ROI)

- Can articulate the alignment and value to frugal procurement, finance and objectives who will be scrutinizing your renewal.

As you focus first on existing customers, you need to understand that renewals are not guaranteed and should not be taken for granted. Every supplier is at risk of consolidation, and every purchase order is subject to discounting or embargo. You should not delay making sure that your buyer:

In your next quarterly business review your growth sales reps and customer success specialists need to evolve from a focus on usage and adoption to proactively quantifying the value your solution has delivered. Tallying the impact to key performance metrics, how this translates to savings, productivity improvements, risk reduction and growth, and how this compares to the investment will help to move the renewal discussion from cost to value, helping to prevent churn and discounting.

Once the renewal is secure, your customer success team and growth sales reps can pivot to expand selling opportunities. Leveraging the value already delivered, the team can further proactively analyze the quantifiable value that can be achieved from expanded use cases, solution sets and licensing.

As you will be relying on your buyer to make the internal case for renewal and expansion, the key is to proactively arm your buyer with the value quantification and communication they need to meet spending cuts and mandates head-on with frugal procurement, financial and executive team members.

Frugal New Prospects

New customers will be looking for ideas to help them survive through the crisis and achieve new business goals. However, at the same time, target accounts will be looking to consolidate supplier relationships, and won’t be actively seeking new relationships, but this doesn’t mean there aren’t opportunities.

Most buyers will be willing to have you help benchmark and assess issues and obtain advice about unmet needs. They’ll even consider your new solution proposal, as they have a job to do and still make progress in their business. However, they will run into centralized control and mandates that will put massive roadblocks in their way, taking extra creativity, facilitation and patience to get through.

-

As you seek to gain business from new customers, your prospects will need ammunition to help executives on the buying and approval committee understand:

- How your solution helps the organization achieve new or prioritized strategic objectives

- What specific and tangible cost savings, efficiency benefits and risk avoidance your solution is expected to deliver over the next 12 months

- How your solution delivers this with low-to no upfront costs and risks

The Bottom-Line

Your customers and prospects have instantly moved from growth to cost-cutting mode. Frugalnomics is in full effect, and as a result, you and your team will face pressure on each renewal, expansion and new customer proposal.

-

The key to succeeding in this new environment? Arm every one of your prospect and customer champions with the financial justification needed to convince frugal procurement, finance and executives that your proposal should be a top-priority despite the spending freeze and cutbacks. This includes proactively:

- Aligning how your solution helps the organization solve a new set of objectives and priorities

- Quantifying and communicating the tangible value you have already delivering to customers or are proposing for prospects, specifically focusing on savings, reduced business risk and enabling the organization to “do more with less”

- Tallying the ROI (discounted cash flow) to demonstrate the superior returns and low risk of the renewal, expansion or proposed new solution.

How do you accomplish this? Many organizations leverage value consultants to create custom analyses for prospects and customers. This delivers the goods, but only for eight or so prospects and customers a quarter for every value consultant on your team. This when hundreds of prospects are in need of financial justification.

Because every substantial new proposal, renewal and expansion will now need financial justification in this environment, you have to scale your program beyond what just a few value consultants can deliver, enabling financial justification to be developed and delivered by sellers, specialists and partners in all substantive deals.

And creating and delivering a spreadsheet-based financial justification tool won’t get the job done, unless you are a value consultant who lives in the financials all day long. Your sellers, specialists and partners often reject the spreadsheet as too complex and cumbersome to use (along with these other inherent issues – https://www.mediafly.com/7-reasons-not-to-value-sell-with-spreadsheets/)

-

In order to scale, we recommend that instead of throwing more value consultants at the challenge (almost impossible under current budget constraints) or designing and delivering a complex spreadsheet, that you instead arm every seller, specialist, and partner with a customized interactive tool to help collaborate with buyers on:

- Uncovering key challenges and opportunities

- Tallying the potential savings and business value impacts your solution can uniquely deliver

- Communicating the storytelling and evidence to validate the savings and business value assumptions

- Comparing the savings and business value impacts with the proposed solution investment

- Preparing a CFO business case / financial justification report.

To help you develop and deliver a more scalable financial justification program, we have a special JumpStart ROI program to help. In less than two weeks, you can go from having no financial justification, a value consultant-led or spreadsheet-based program, to enabling every one of your sales reps, specialists and partners to interactively collaborate with customers and deliver hundreds of financial justifications each month.

Email me personally at tpisello@www.mediafly.com to learn more and get started scaling your financial justification right away.

Source: PwC’s COVID-19 CFO Pulse Survey, US findings — April 13, 2020, reflects the views of 313 US finance leaders

https://www.pwc.com/us/en/library/covid-19/pwc-covid-19-cfo-pulse-survey.html

#PwC #spendingfreeze #valueselling #valuemarketing #financialjustification #ROI #businesscase #valuemanagement #RealizedROI #Frugalnomics #valuestorytelling #frugal

Comments are closed.