Many companies are using the crisis to reconsider the priority of proposed projects, realign their budgets and slash spending.

Goldman Sachs reports that the biggest US companies will cut spending by a record 33% during 2020, including a sharp 27% reduction in capital expenditures, a 9% pullback in R&D and a 26% plunge in investment for growth.

Research firm Gartner indicates that companies are indeed cutting back on their technology spending, but at the same time balancing conservatism with the need to drive digital transformation: to be ready post-crisis to accelerate and capture growth. According to Gartner, “The crisis is creating unprecedented pressure on enterprise leaders to do more with less. But that budget urgency only increases the need to assess cost initiatives strategically — to make sure that near-term decisions don’t jeopardize the ability of your organization to sustain through the crisis and do protect what it needs to drive recovery.”

Frugalnomics is in effect, with many organizations seeking ways to reduce spending and do more with less, while trading off projects and proposals company-wide in order to assure future success.

-

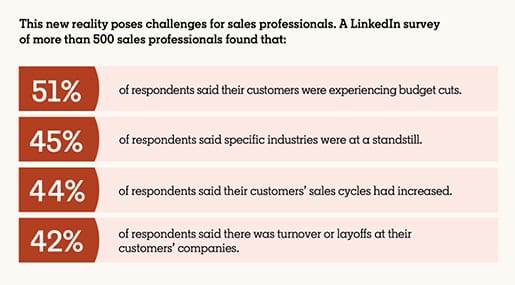

Sellers report hearing similar issues from their customers, with

- 51% indicating their customers were experiencing budget cuts

- 45% saying that specific industries were at a standstill

- 44% responding that their customer decision cycles have extended (LinkedIn)

-

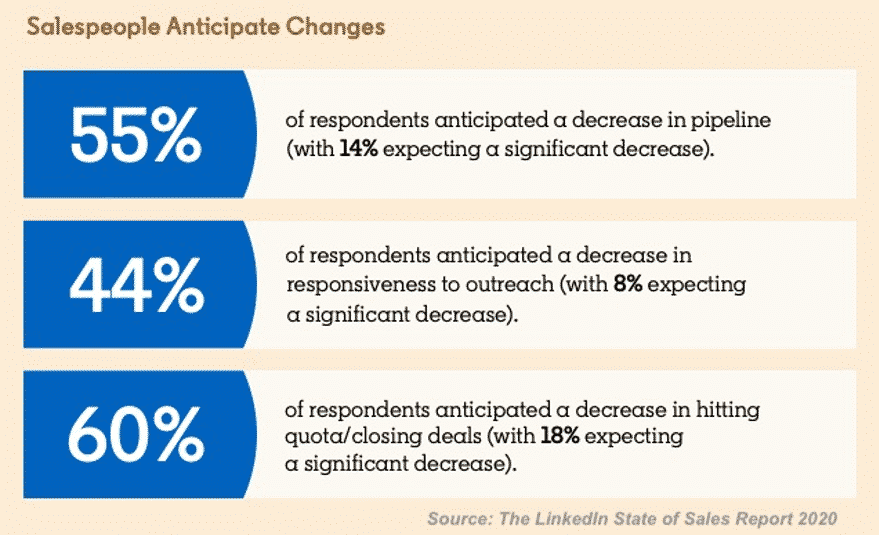

And this is already impacting sellers in a significant way, with:

- 44% of salespeople experiencing a decrease in responsiveness to their outreach efforts

- 55% anticipating a shrinkage in the number of deals in their sales pipeline

- 60% of salespeople projecting a decrease in hitting quotas/closing deals (LinkedIn)

So how can you enable your sellers help customers to overcome their post-crisis budget challenges and get their quota and other metrics moving in the right direction again?

We recommend the following:

1) Align with key post-crisis business priorities – Your customer priorities and challenges have likely shifted and changed as a result of the crisis and hangover. The big question to ask: Are you realigned with these new priorities? When it comes to getting outreach noticed, you will need to resonate with buyers around their new priorities.

For example, if you are a BI company selling to retail, messaging around using historical data to better generate growth might not be well received, as the crisis is a singularity rendering the historical trends irrelevant. However, a guide on how to leverage current data to quickly recognize cost saving opportunities, get loyal customers targeted and back to spending, and anticipate new post-crisis buying trends could be the ticket.

Reconfigure your messaging and solutions around key post-crisis challenges with practical use cases that can be implemented quickly – with as little investment and risk as possible.

From the initial messaging, you have to assure that your presentations and proposals, remain focused on these key business priorities. Many of your customers have setup COVID buying committees and hurdles, designed to review spending and proposed projects company-wide.

In order to elevate, your sellers need to reiterate the key business objectives and emphasize the cost of “do nothing” different in each presentation and the proposal. This can help ensure that all stakeholders and committee members understand the priority of addressing your proposed initiative first and foremost (in the sea of all the other projects customer wide).

2) Proactively articulate business value to all stakeholders and provide financial justification – According to Gartner, “Focusing on business outcomes leaves less room for haggling over cost cuts — and lessens the risk that investments will simply flow to those who shout the loudest. Your proposal is now not only competing with the status quo, but also competing with every other project company wide.

You can stand out by delivering a business case to help justify the solution to each stakeholder. Remember, customers don’t always ask for what they need, so each seller will need to prepare and deliver a business case on every significant deal (typically $50k or above).

-

The business case should:

- Not just be about the financial numbers but communicating a “value story” about the challenges the prospect faces, loss, opportunity, solution and evidence – leveraging CLOSE messaging.

- Contain personal and business value messaging and quantification for each group and stakeholder taking advantage of your proposed solution, as the decision will be “by committee”

- Quantify the cost of “do nothing”, a more significant motivator than just the value of change.

- Focus on the process of collaborating with the customer on the business case and the different experience delivered as a result, as opposed to getting the financial justification right down to the decimal.

3) Amplify trust – Buyers are more risk averse in times of uncertainty. As a result, building trust with buyers, to overcome perceived risk is more important than ever.

According to LinkedIn, “The percent of buyers who agree that the salespeople they ultimately do business with are “trusted advisors.” At the same time, just 40% of decision makers describe the sales profession as “trustworthy.”

Customers buy from sellers they trust, but unfortunately 60% of sellers are not perceived as “trustworthy”, this at a time where trust will be a major factor to achieve “Yes”.

-

Post crisis, sellers will not only need to be viewed as “trustworthy” but will need to amplify trust. To do this, the seller will need to be enabled to better:

- Deliver on everything they promise, from first contact through delivery

- Not oversell, admitting areas where the solution might not deliver and embracing rather than hiding flaws: being “flawsome” (Caponi)

- Deliver more third-party validation on the proposed solution including more sharing of reviews, analyst validations and success stories.

- Reshape proposals to ensure and guarantee business value outcomes.

The Bottom-Line

Business is not “as usual” for your customers, and your sellers will be impacted. Sellers need to be enabled to “do differently” to help your customers buy in these difficult times. Sales enablement, value consultants and marketing can help by delivering the messaging, content, tools and training to help sellers better align with key post-crisis business objectives, proactively communicate and quantify value to each stakeholder and amplify trust.

Sources:

Goldman Sachs – Biggest US Companies Cut Spending 33% in 2020

https://www.businessinsider.com/goldman-sachs-biggest-us-companies-cut-spending-33-in-2020-2020-4?utm_medium=social&utm_campaign=sf-bi-main&utm_source=facebook.com&sfns=mo

Gartner – How to Pick Your Best Cost Initiatives

https://www.gartner.com/smarterwithgartner/how-to-pick-your-best-cost-initiatives

LinkedIn State of Sales Report 2020- Data from two surveys, one conducted in April 2020 among 511 North American sales professionals, and another conducted in March 2020 among 660 sales professionals and business leaders from around the world –

https://www.linkedin.com/business/sales/blog/b2b-sales/introducing-the-state-of-sales-2020

The Transparency Sale, Todd Caponi – https://www.transparencysale.com/

#Salesenablement #Salestransformation #Challenger #TransparencySale #GoldmanSachs #Gartner #LinkedIn #Frugalnomics #Valuemessaging #Valueselling #salestools #sellingtools #salestechnology #salestech #digitalselling #remoteselling #revenueenablement #salesperformance #salesoptimization

Comments are closed.