Leveraging Sales, Content and Value Enablement to Reduce Decision Friction and Drive Purchase Decisions

I couldn’t wait to dig into the 2021 B2B Buyer Survey from DemandGen Report, as its annual survey is always packed with useful insights and actionable knowledge. And who doesn’t need more intelligence on the latest buyer trends and guidance on how to evolve post-crisis to engage better and win more business.

Looking through the research findings, a couple of data points stood out to me.

1) Spending slowdown or acceleration? – First, although certain companies might have cut back on spending, way more are investing in digital and business transformation, trying to capture competitive advantage and growth opportunities. This is fantastic news and reflected in the overflowing pipelines of many of the companies we work with.

According to the findings:

- Almost 90% of overall respondents pointed to ramping up their purchasing decisions over the past 12 months

- 33% of respondents indicated that their buying decisions and timelines were escalated due to the changes of 2020 (versus just 20% who have had to delay or cancel purchases due to budget freezes)

Business is clearly moving forward, and there are deals to be had out there with both new prospects and existing accounts.

2) Decision Friction – Despite an ever-increasing need for faster decisions to meet rapidly urgent business goals and objectives, buyers are having a hard time getting decisions made. Decision by committee has led to a decided slowdown in the process.

Buying committees have been formed or added to vet and scrutinize significant purchase decisions. Over the past 12 months 19% of companies responding to the DemandGen Report survey formed buying committees for the first time, alongside the 49% of respondents who already utilized them in the past.

A majority, 55% responded that because of this and other factors, the decision-making process takes longer, with 21% of those indicating that the time it takes to make a purchase increased significantly.

3) The content you share and how your sellers engage really does matter – What led to faster, positive decisions? The top-three factors that influenced buying decisions were indicated as:

1. Easy access to relevant content that speaks directly to their company

2. Easy access to pricing and competitive information

3. Content that spoke directly to and demonstrated expertise around the needs of the organization’s specific industry.

With the buying committees consisting of a variety of roles and responsibilities, having a seller that helped facilitate the decision-making process, and the right content to inform the different buyers had a significant influence on the purchase. Personalization and relevancy shine through.

In fact, when it comes to content, 80% of respondents indicated that a vendor’s content had a positive, significant impact on their buying decisions.

And with regard to sellers, despite the predicted “death of the B2B sales rep” some six years ago, sellers really do matter, with:

- 60% of respondents agreeing that sales rep knowledge influenced decision-making

- 23% indicating they would like more (not less) hands-on attention / engagement from solution providers to help generate ideas and make decisions.

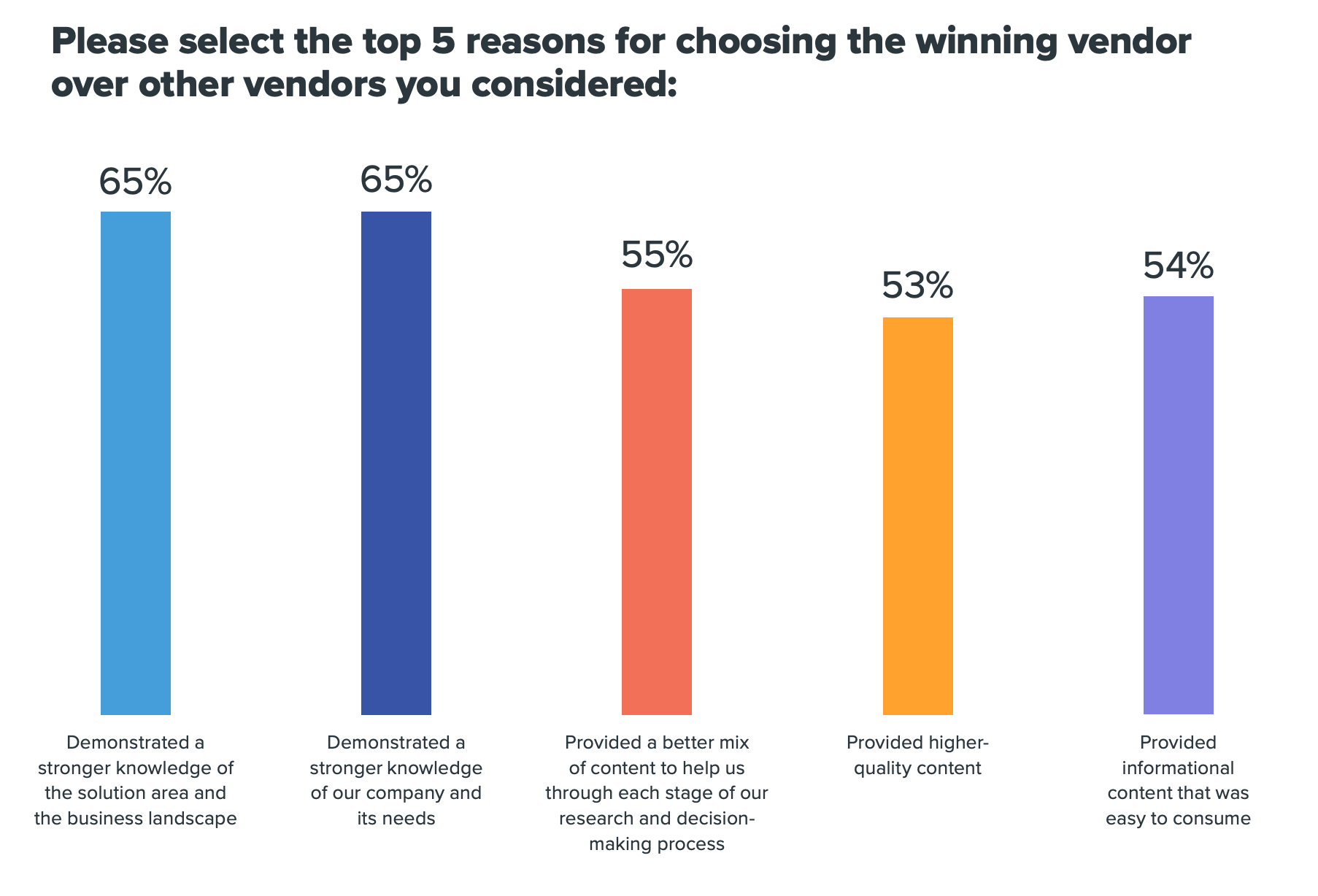

When taking a holistic view at the top reasons a vendor was able to get to “Yes”, DemandGen Report revealed that the top five reasons included sellers and solution providers who especially:

1. Demonstrated a strong knowledge of the solution area and landscape (65%)

2. Demonstrated a strong knowledge of the company and its needs (64%)

3. Provided a better mix of high-quality content (55%)

4. Provided content that was easier to consume (54%)

5. Provided higher-quality content (53%).

However, as have been the results of recent studies by LinkedIn, Forrester and the RAIN Group, DemandGen Report also found a decided gap in what a buyer wants, and what solution providers, and especially sellers were providing. The engagement gap is real, and represents a great opportunity for sales, content and value enablement to help.

When asked about areas of improvement, study respondents suggested sellers could better:

1. Review objectives and expectations in more detail, instead of jumping to “solutioning”

2. Discuss how the solution or product would directly benefit a particular company, more clearly communicating and quantifying value

3. Make a personal connection, even if we are engaging virtually and remote

4. Supply relevant case studies, success stories and evidence proof-points

5. Provide more, better support during the implementation period (not just sell me and move on).

The Bottom Line

Evolving business needs are accelerating the need for purchases meaning significantly more opportunity, but decision friction makes it harder to get these opportunities across the finish line in a timely manner.

Having the right content, and superior selling skills have been found to make a big difference between deals pushing another quarter out or ending in “no decision” versus getting to “Yes”.

And here-in lies the great opportunity for sales, content and value enablement, to create content that can facilitate complex buying decisions and influence decision by committee.

Learn more:

Complete Guide to Engaging the Modern Buyer –

https://www.mediafly.com/guide/complete-guide-to-engaging-the-modern-b2b-buyer/

How Sales Enablement Technology Can Help You Overcome 10 Common B2B Challenges – https://www.mediafly.com/guide/how-sales-enablement-technology-can-help-you-overcome-10-common-b2b-challenges/

Source:

2021 B2B Buyers Survey – As Buying Committees Expand, Unique Patterns Emerge Among Different Stakeholders – https://www.demandgenreport.com/resources/research/2021-b2b-buyers-survey-as-buying-committees-expand-unique-patterns-emerge-among-different-stakeholders/

Comments are closed.